No products in the cart.

Mastering the Art of Investing: A Guide for College Students

Learn the fundamentals of investing tailored for college students, including risk profiles and strategies to grow your wealth safely.

New York, USA — As college students prepare to step into a world filled with opportunities and challenges, many are realizing that financial literacy is no longer just an option; it’s a necessity. The days of relying solely on parents for financial guidance are fading, and a new generation is taking charge of their financial futures. But where to start?

Investing can seem daunting, especially for those who are still grappling with the complexities of student loans and budgeting for textbooks. However, understanding the basics of investing can empower young adults to build wealth, secure their financial future, and even fund their dreams. This isn’t just about making money; it’s about learning to make informed decisions that will impact their lives for years to come.

Many new investors are often overwhelmed by the plethora of options available. Should they dive into the world of stocks, or is it wiser to start with index funds? The answer largely depends on individual risk profiles and financial goals. Risk profiles can be broadly categorized into three types: conservative, moderate, and aggressive. A conservative investor might prefer the stability of bonds or index funds, which generally offer lower returns but also less volatility. In contrast, an aggressive investor may lean towards individual stocks, seeking higher returns but also accepting the risk of significant losses.

For college students, starting small is the name of the game. Investing doesn’t require a large sum of money to begin. Many apps and platforms now allow individuals to start investing with as little as $5. This democratization of investing is particularly appealing to young adults who might still be navigating part-time jobs or internships. By starting small, students can familiarize themselves with market trends without risking their entire savings.

For college students, starting small is the name of the game.

One of the most effective strategies for beginners is to consider a Systematic Investment Plan (SIP). This approach allows investors to contribute a fixed amount regularly, smoothing out market volatility over time. SIPs can be a great way for college students to automate their investments, making it easier to stick to a budget while watching their money grow.

Index funds also deserve a spotlight in the conversation about beginner investing. These funds track a specific index, such as the S&P 500, and offer a diversified investment option with lower fees compared to actively managed funds. For a college student who might be overwhelmed by the thought of picking individual stocks, index funds provide a straightforward and effective way to gain exposure to the market.

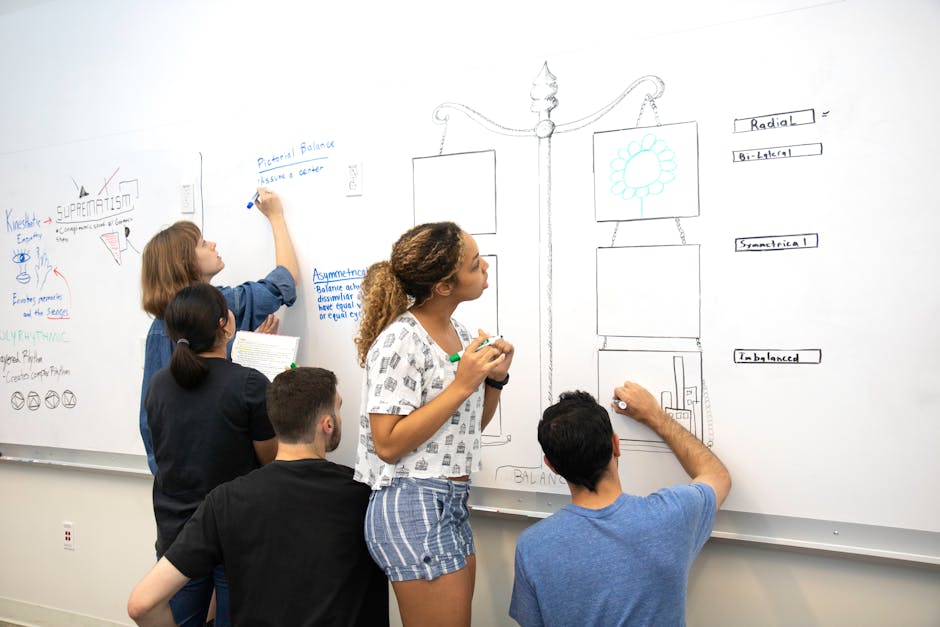

To deepen their financial knowledge, college students have a wealth of resources at their fingertips. Online courses, podcasts, and books tailored to young investors have proliferated in recent years. Websites like Investopedia offer tutorials that break down complex financial concepts into digestible lessons. Furthermore, many universities now offer courses in personal finance and investment strategies, reflecting a growing recognition of the importance of financial literacy in higher education.

However, it is crucial to address the psychological barriers that can accompany investing. Fear of loss can paralyze even the most promising investors. In an era where information is abundant and opinions are varied, students must learn to filter noise and focus on their long-term goals. This requires discipline and a willingness to learn from mistakes, which is an essential part of the investment journey.

Moreover, students should be wary of the “get rich quick” mentality that often pervades social media. While stories of overnight success can be enticing, they can also lead to reckless decisions. Understanding that investing is a marathon, not a sprint, is vital for anyone looking to build wealth over time.

In an era where information is abundant and opinions are varied, students must learn to filter noise and focus on their long-term goals.

As students embark on their investment journeys, they must remember that the earlier they start, the greater their potential for wealth accumulation. The power of compound interest can turn modest investments into substantial sums over decades. This principle is a cornerstone of wealth building and can help students achieve their financial goals, whether it’s buying a car, funding further education, or even purchasing a first home.

In conclusion, becoming a savvy investor is not an unattainable dream for college students. With the right resources, mindset, and strategies, they can navigate the world of investing with confidence. As they learn to harness the power of their money, they are not just preparing for their financial futures; they are also equipping themselves with skills that will serve them for a lifetime. The journey of investing begins with a single step, and for many, that step could be the difference between financial struggle and financial freedom.