No products in the cart.

IBPS Clerk Prelims Result 2025 Likely Soon At ibps.in, Mains Exam On November 29

Aspiring banking professionals await the imminent IBPS Clerk Prelims Result 2025, with the crucial Mains Exam scheduled for November 29, offering a gateway to stable careers in India's public sector banks.

New Delhi, India – The career aspirations of thousands of young professionals across India are set to take a significant step forward as the Institute of Banking Personnel Selection (IBPS) is expected to release the Clerk Prelims Result for the 2025 recruitment cycle imminently. This crucial announcement, anticipated to be available on the official IBPS website, ibps.in, will determine eligibility for the subsequent Mains Examination, which is firmly scheduled for November 29, 2024. For individuals aged 16 to 35, securing a clerk position in a public sector bank represents a stable, rewarding career path with substantial growth opportunities within India’s robust financial sector.

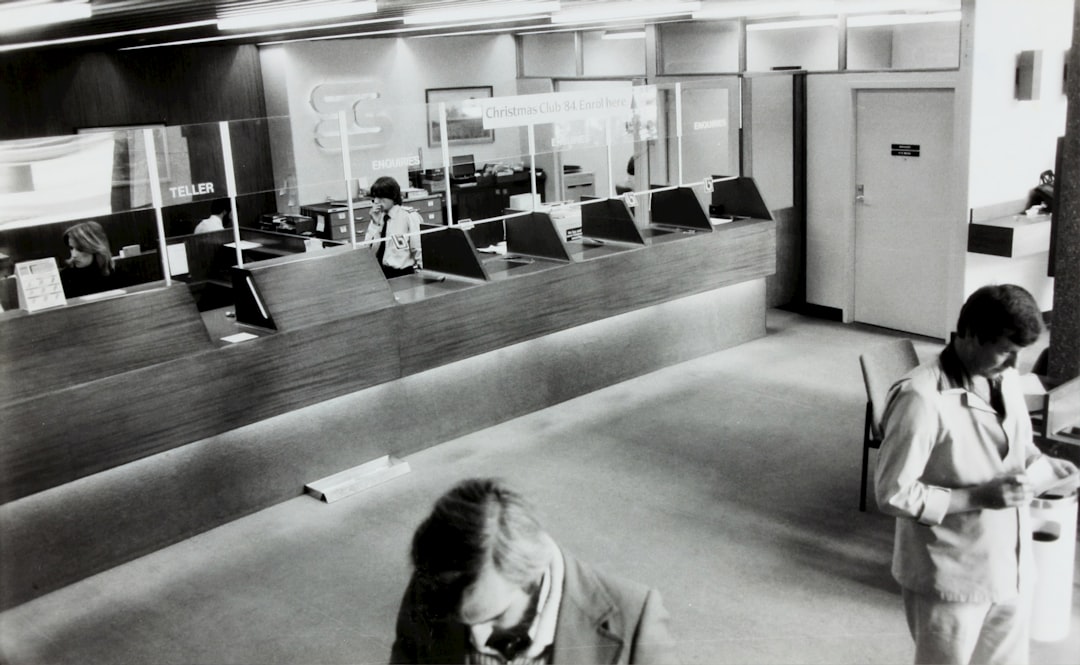

The IBPS Clerk examination is a highly competitive gateway to entry-level roles in various public sector banks, including the State Bank of India and other nationalized banks. These positions are foundational, offering a comprehensive understanding of banking operations and direct engagement with customers. The upcoming result declaration and the subsequent Mains exam are pivotal moments for candidates who have dedicated months to rigorous preparation, aiming to join a sector that continues to be a cornerstone of India’s economic landscape. Success in these examinations not only provides job security but also opens doors to further professional development and upward mobility within the banking hierarchy.

Navigating the IBPS Clerk 2025 Cycle: Results and Immediate Next Steps

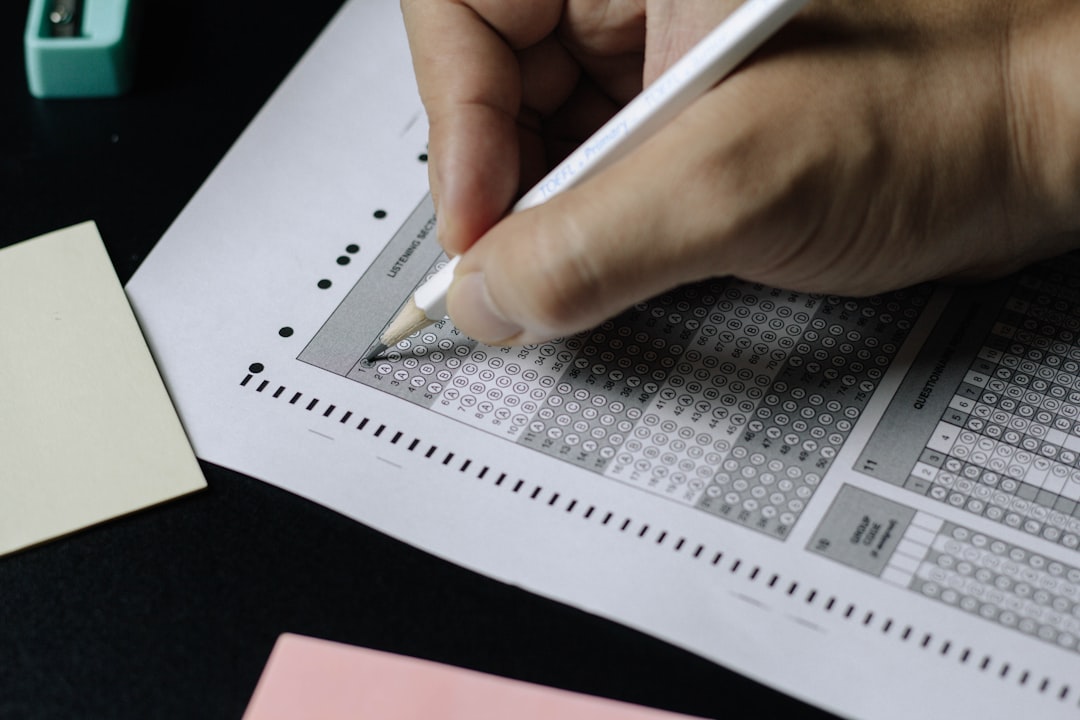

The release of the IBPS Clerk Prelims Result 2025 is a moment of high anticipation. Candidates are advised to regularly check ibps.in for the official notification. Once declared, the result will list the roll numbers of candidates who have qualified for the Mains Examination. This initial screening process assesses fundamental aptitude in areas such as Reasoning Ability, Quantitative Aptitude, and English Language. Qualifying for the Mains is a testament to a candidate’s foundational knowledge and readiness for more advanced challenges.

With the Mains Exam slated for November 29, 2024, successful Prelims candidates will have a concentrated period for intensive preparation. The Mains examination is significantly more comprehensive, covering Reasoning Ability & Computer Aptitude, General/Financial Awareness, English Language, and Quantitative Aptitude. Each section carries specific weightage, demanding a balanced and strategic approach to study. “The time between Prelims results and Mains is critical. Candidates must shift their focus immediately to the Mains syllabus, prioritizing General/Financial Awareness and Computer Aptitude, which are new additions compared to the Prelims,” advises Dr. Anjali Sharma, Head of Career Services at Zenith Institute, a leading coaching center for banking aspirants.

Career Development

Career DevelopmentBridging the Language Gap: Empowering Health Professionals in Florida

TruMerit and EnGen are helping foreign-educated health professionals in Florida enhance their English skills, paving the way for career advancement.

Read More →Effective preparation for the Mains involves not just theoretical knowledge but also rigorous practice through mock tests. Analyzing performance in these tests helps identify weak areas and refine time management strategies, which are crucial for success in a high-stakes competitive exam. Furthermore, staying updated on current affairs, particularly those related to the banking and financial sectors, is indispensable for the General/Financial Awareness section. This period demands discipline, focus, and a well-structured study plan to maximize the chances of securing a coveted position.

Analyzing performance in these tests helps identify weak areas and refine time management strategies, which are crucial for success in a high-stakes competitive exam.

The Bank Clerk Role: A Foundation for Growth in Public Sector Banking

A bank clerk’s role is multifaceted and vital to the smooth functioning of any public sector bank. Responsibilities typically include customer service, cash handling, account opening, processing transactions, managing remittances, and various back-office operations. These roles are the frontline of banking, requiring strong interpersonal skills, accuracy, and a customer-centric approach. Public sector banks in India are known for offering robust job security, comprehensive benefits, and a structured career progression path, making them highly attractive to young graduates seeking long-term stability.

Entry-level bank clerks can expect a starting salary package, including basic pay and various allowances (such as Dearness Allowance, House Rent Allowance, Special Allowance, and Transport Allowance), ranging from approximately ₹30,000 to ₹35,000 per month. This competitive remuneration, coupled with a stable work environment, makes the IBPS Clerk position a desirable career launchpad. Annually, IBPS typically facilitates recruitment for over 4,000-5,000 clerk vacancies across participating banks, reflecting a consistent demand for skilled personnel in the sector.

Beyond the initial role, a clerk position serves as an excellent foundation for career advancement. With experience and through internal promotional exams or further competitive examinations like IBPS PO (Probationary Officer) or SBI PO, clerks can ascend to officer and managerial positions. This upward mobility is a significant draw, offering opportunities for increased responsibility, higher salaries, and specialized roles within the banking ecosystem. “The public sector banking sector values dedication and continuous learning. A clerk who demonstrates strong performance and proactively upskills can expect a clear trajectory towards leadership roles within 5-7 years,” states Mr. Rajesh Kumar, a veteran HR consultant specializing in public sector recruitment.

Strategic Preparation and Future Outlook: Beyond the Mains Exam

For those who successfully clear the Mains Examination, the journey doesn’t end there. While the IBPS Clerk selection process typically does not include an interview stage, the final merit list is prepared based on the Mains exam scores. Therefore, maximizing performance in the Mains is paramount. Beyond securing the job, aspiring bankers should adopt a future-looking perspective, focusing on continuous skill development to thrive in an evolving financial landscape. The next 6-24 months post-recruitment are crucial for consolidating knowledge and preparing for future career milestones.

Career Development

Career DevelopmentNavigating Careers in the Space Economy: 2025 and Beyond

The space economy is booming, offering diverse career paths in satellite data, lunar logistics, and astro-law. Discover how to position…

Read More →The banking sector is undergoing rapid digital transformation, with an increasing emphasis on digital literacy, cybersecurity awareness, and proficiency in new banking technologies. Clerks entering the system today will benefit immensely from proactively learning about digital payment systems, mobile banking applications, and data analytics tools. Developing strong communication skills, problem-solving abilities, and adaptability to technological changes will be key differentiators for career growth. These skills are not just beneficial for daily tasks but are essential for qualifying for internal promotions and higher-level competitive exams.

Looking ahead, a career in public sector banking offers stability and a platform for significant professional development. Aspiring candidates should view the IBPS Clerk exam not just as a job application but as the first step in a long-term career strategy. Investing in continuous learning, staying abreast of financial market trends, and cultivating a strong professional network will pave the way for a successful and fulfilling career in India’s dynamic banking sector. The imminent Prelims result and the approaching Mains exam are critical junctures, demanding immediate and focused action from every candidate.

Beyond securing the job, aspiring bankers should adopt a future-looking perspective, focusing on continuous skill development to thrive in an evolving financial landscape.

Sources:

News18 (2024-10-28)

AI

AIRevolutionizing Hospitality: The Future Workforce in an AI-Driven Era

AI is set to redefine hospitality careers, from guest services to smart rooms. Discover the future of work in this…

Read More →Sources: News18 (2024-10-28)