No products in the cart.

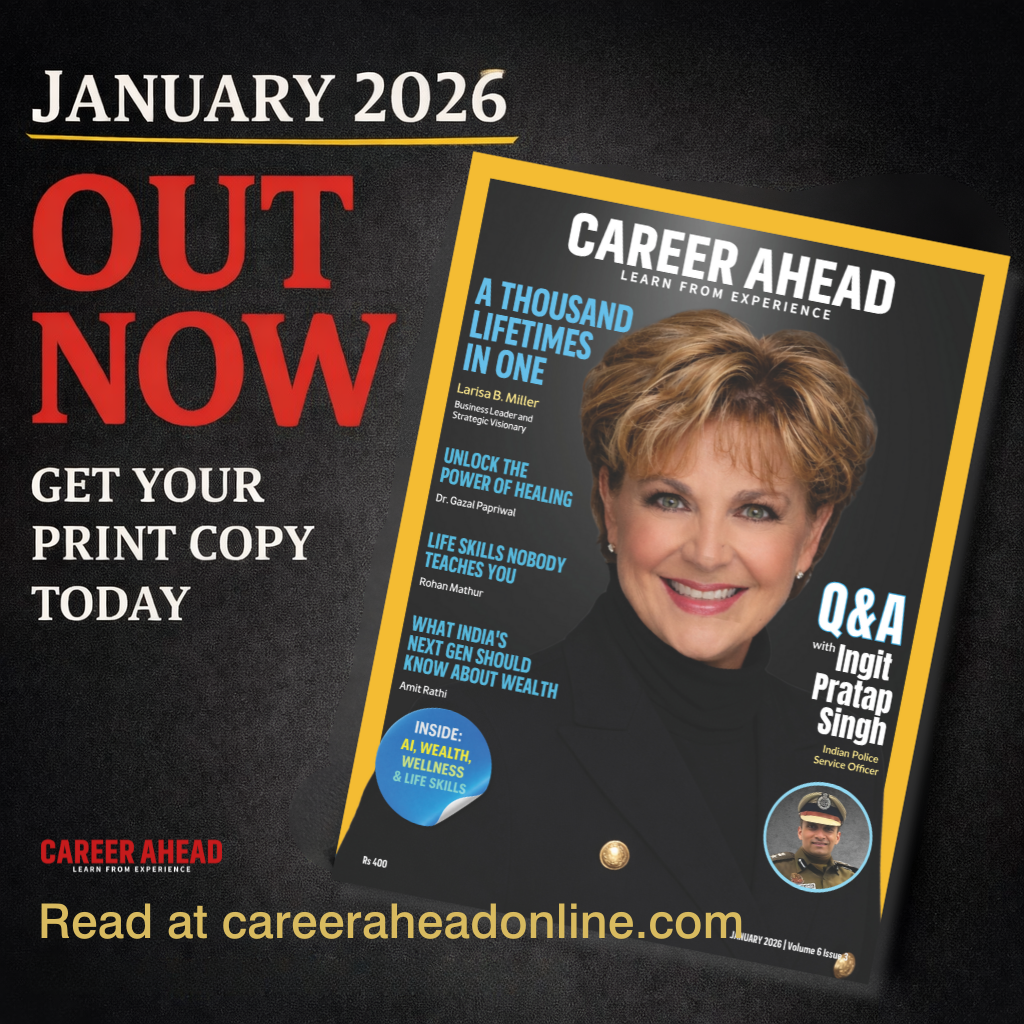

Gen Z’s Financial Revolution: How Young Consumers Are Redefining Banking

Gen Z is transforming banking with digital-first solutions and a focus on values. Explore the implications for financial institutions and consumers.

San Francisco, USA — Gen Z is not just participating in the financial system; they are reshaping it. This generation, born between 1997 and 2012, is leading a shift towards digital-first, value-driven banking solutions. With a focus on transparency, sustainability, and innovation, their preferences are forcing traditional banks to rethink their strategies and operations.

The urgency of this transformation cannot be overstated. As of 2025, Gen Z will make up approximately 30% of the global workforce and wield significant purchasing power, estimated at $143 billion annually in the U.S. alone [1]. Their financial habits, influenced by their upbringing during the Great Recession and the pandemic, prioritize digital accessibility and ethical considerations. This trend is not merely a passing phase; it represents a fundamental change in how banking services are conceived and delivered.

The backdrop for this shift includes a rapid evolution in technology and a growing distrust of traditional financial institutions. A 2023 survey by Deloitte revealed that 60% of Gen Z respondents prefer using fintech apps over traditional banks for everyday transactions [2]. Companies like Chime, Cash App, and Revolut have capitalized on this demand, offering user-friendly interfaces and lower fees. Chime, for instance, reported a user base growth of over 50% year-on-year, reaching 12 million users in 2024 [3].

Health And Wellbeing

Health And WellbeingFunding Round-up: Key Startups and Investments Making Waves

This week’s funding round-up highlights key acquisitions and investments in the startup ecosystem, showcasing trends and opportunities.

These fintech solutions resonate with Gen Z’s desire for control and customization. They allow users to manage their finances in personalized ways, integrating budgeting tools, savings features, and investment options—all in one app. This flexibility is particularly appealing to a generation that prioritizes financial literacy and empowerment.

Chime, for instance, reported a user base growth of over 50% year-on-year, reaching 12 million users in 2024 [3].

Moreover, the rise of cryptocurrency and digital wallets is another facet of Gen Z’s financial revolution. According to a report from the Financial Industry Regulatory Authority (FINRA), nearly 50% of Gen Z investors have engaged in cryptocurrency trading [4]. This trend reflects their comfort with technology and a willingness to explore alternative investment avenues. As traditional banks scramble to integrate these features, the challenge remains: how can they compete in an increasingly decentralized financial landscape?

Critics argue that while fintech offers convenience, it also raises concerns about security and regulatory oversight. Traditional banks, with their established frameworks, provide a sense of security that many younger consumers may overlook. However, as digital-native users grow more comfortable with technology, the demand for robust cybersecurity measures is paramount. Financial institutions must adapt, not only to meet these expectations but also to educate users about safe practices.

Career Development

Career DevelopmentMPPSC Opens 155 Vacancies for State Service Exam Recruitment

MPPSC has announced 155 vacancies for the State Service Exam. Applications will be accepted starting January 10, 2026, until February…

Read More →As the landscape evolves, the role of financial education becomes crucial. Many Gen Zers are eager for knowledge but often lack access to comprehensive financial literacy programs. Institutions that proactively offer educational resources—whether through workshops, webinars, or integrated app features—will likely gain a competitive edge. A 2023 study by the National Endowment for Financial Education found that 80% of young adults wish they had received more financial education in school [5].

Looking ahead, the financial sector is poised for further disruption as Gen Z continues to mature. Their preferences will likely shape the development of new products and services tailored to their unique needs. As banks and fintech companies strive to innovate, collaboration may emerge as a key strategy. Partnerships between traditional banks and fintech firms could lead to hybrid solutions that merge the best of both worlds—security and innovation.

Institutions that proactively offer educational resources—whether through workshops, webinars, or integrated app features—will likely gain a competitive edge.

Ultimately, the future of banking is not just about technology; it’s about understanding and responding to the values that drive consumer behavior. Will financial institutions rise to the challenge and embrace this new paradigm, or will they risk becoming obsolete in a rapidly evolving digital economy? The answers to these questions will define the next chapter in the banking narrative.

Digital Citizenship

Digital CitizenshipThe Rise of Digital Citizenship: Navigating New Norms

Digital citizenship is reshaping education and the workforce. Discover its implications and how to adapt to these changes.

Read More →