No products in the cart.

JM Financial’s Shift: Private Markets as the New Profit Engine

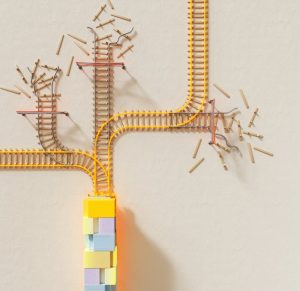

JM Financial is restructuring its focus towards private markets as a key growth engine, according to Vishal Kampani.

Mumbai, India — JM financial is redefining its growth strategy by placing a strong emphasis on private markets. Vice Chairman and Managing Director Vishal Kampani revealed that this focus could position private markets as the leading profit driver for the company in the coming years. With a significant restructuring over the past year, JM financial aims to capitalize on opportunities in private equity and structured credit, potentially surpassing traditional capital markets in profitability.

The shift towards private markets comes at a time when the broader financial landscape is evolving. According to Kampani, JM Financial has allocated ₹6,000 crore specifically for private market investments, which is the largest allocation among its various business segments. This strategic move reflects a growing trend where private markets are seen as a more lucrative avenue for growth compared to public markets, especially in the context of the fluctuating IPO landscape.

JM Financial’s restructuring has led to the establishment of four core business areas: capital markets and corporate advisory, wealth and asset management, private markets, and affordable home loans. The company has onboarded 1,000 salespeople to bolster its wealth management segment, indicating a commitment to scaling operations in this area as well. However, the real game-changer appears to be the private markets segment, which Kampani believes could outpace capital markets in profitability within the next two to three years.

Why Private Markets Are Gaining Traction

The allure of private markets lies in their potential for higher returns. Kampani notes that private markets globally are substantial, and India is beginning to catch up. The firm engages with companies five years before they hit the IPO market, allowing them to build relationships and understand the companies’ growth trajectories. This long-term approach enables JM Financial to provide tailored financial solutions, from promoter-level funding to pre-IPO support.

Innovation

InnovationThea Energy Unveils Helios: A Game Changer in Fusion Power

Thea Energy introduces Helios, a groundbreaking fusion power plant designed to make fusion energy more accessible and efficient.

Read More →Private equity investments, structured credit, and distressed assets are key components of this strategy. By leveraging its non-banking financial company (NBFC) capital and family office networks, JM Financial is well-positioned to invest in companies valued below ₹3,000 crore. This model not only diversifies their portfolio but also allows them to mitigate risks associated with public market volatility.

The firm engages with companies five years before they hit the IPO market, allowing them to build relationships and understand the companies’ growth trajectories.

According to industry experts, the private markets segment is likely to experience significant growth, particularly as investors seek alternatives to traditional equity markets. A report from PwC indicates that private equity investments in India are expected to grow, driven by increasing capital inflows and a favorable regulatory environment. This trend aligns with JM Financial’s strategy to enhance its private market offerings and capitalize on the growing demand for alternative investment avenues.

Impact on Career Opportunities in Finance

The shift towards private markets will have substantial implications for career opportunities within the finance sector. As JM Financial expands its private markets division, there will be an increased demand for professionals with expertise in private equity, credit analysis, and investment management. Entry-level positions will likely focus on supporting these areas, while mid-career professionals may find opportunities to lead investment strategies and manage client relationships.

According to a recent report by the World Bank, the private equity sector in India is projected to grow significantly, which means that financial institutions like JM Financial will need skilled professionals to navigate this evolving landscape. Workers in finance should consider upskilling in areas such as financial modeling, valuation techniques, and market analysis to remain competitive.

Career

CareerWant a MacBook without AI? Here’s how to turn off Apple Intelligence

As Apple Intelligence rolls out, professionals face a critical choice: embrace AI integration or prioritize human control, shaping new career…

Read More →Furthermore, geographic hotspots for finance careers are shifting. Cities like Mumbai, Bangalore, and Delhi are becoming hubs for private equity firms and investment management companies. Professionals looking to advance their careers should consider relocating to these areas or seeking remote opportunities with firms that focus on private markets.

- Upskill in Private Equity: Consider taking courses in private equity and venture capital to enhance your knowledge and skills.

- Network in Key Markets: Attend industry conferences and networking events in major financial hubs to connect with potential employers.

- Stay Informed: Follow market trends and news related to private markets to understand the evolving landscape and identify opportunities.

However, some experts caution that the private equity boom may not last indefinitely. A recent report by the Harvard Business Review highlights that while private markets currently offer attractive returns, they can also be subject to market corrections and economic downturns. Investors should remain vigilant and consider diversifying their portfolios to mitigate risks associated with overexposure to private equity.

According to a recent report by the World Bank, the private equity sector in India is projected to grow significantly, which means that financial institutions like JM Financial will need skilled professionals to navigate this evolving landscape.

The Future of JM Financial’s Private Markets Strategy

Looking ahead, JM Financial’s focus on private markets is likely to shape its future growth trajectory. As the firm continues to invest heavily in this area, it will be interesting to see how it adapts to market changes and investor preferences. The success of this strategy will depend on JM Financial’s ability to identify promising investment opportunities and navigate the complexities of the private equity landscape.

Moreover, as the competition in private markets intensifies, JM Financial will need to differentiate itself through innovative investment strategies and superior client service. This may involve leveraging technology to enhance investment analysis and decision-making processes.

Career Advice

Career AdviceCampus Connections: The Key to Career Success

Campus networking is vital for career development. Discover how connecting with peers and alumni can shape your future.

Read More →

As private markets continue to evolve, how will JM Financial ensure it remains at the forefront of this lucrative sector? The answer to this question will be crucial for its long-term success and profitability in the years to come.